NYISO Forms a Trend

September 22, 2020

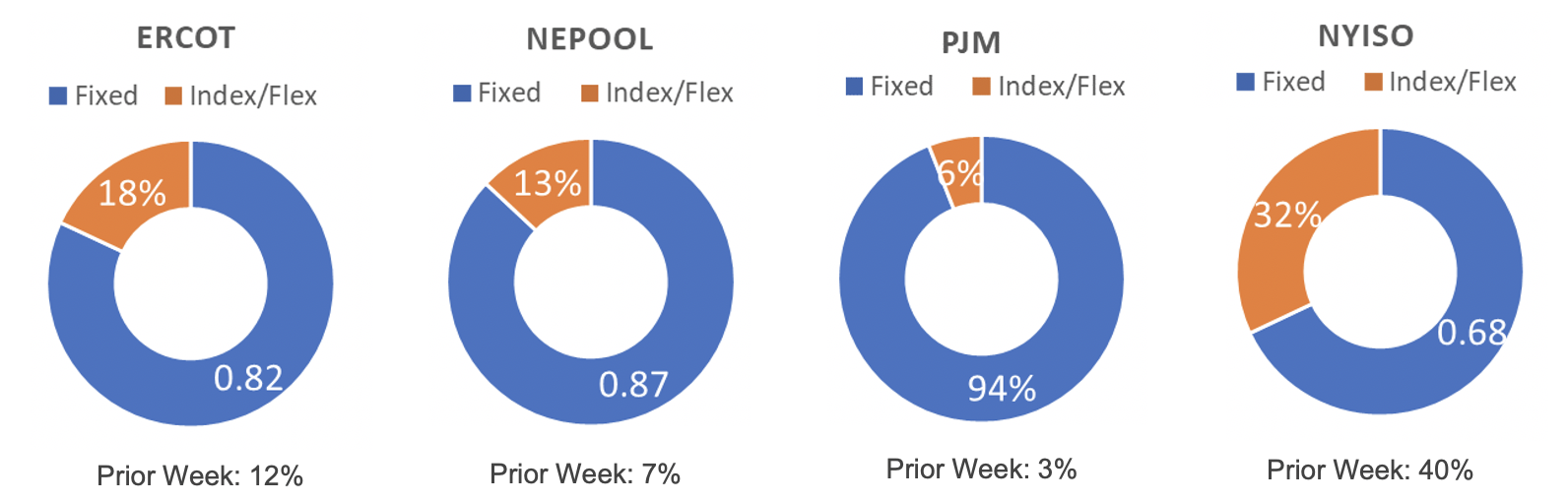

Buyers and brokers in NYISO continue their strong interest in risk related products. At a 32% overall interest in index/flex solutions versus fixed-price solutions, the ratio is historically strong but less than last week’s 40%. PJM participants have a contrarian view at only a 6% interest in index/flex pricing requests.

Risk Appetite Report 9/14/20 – 9/18/20

The risk appetite gauges above reflect the mix of fixed, flex, and index volume that was priced on behalf of customer requests in the period. The total annual MWh priced represents 104,919,084 for customers with peak demand above 750 KWh.