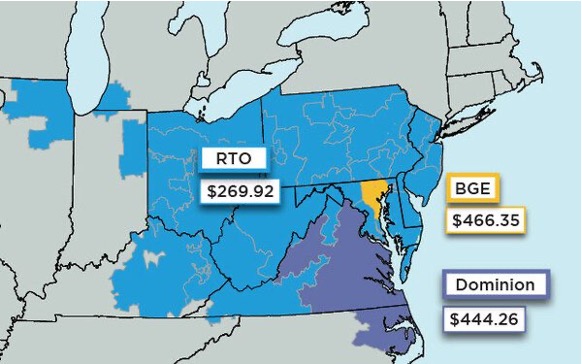

Record Prices for PJM Capacity

Last week’s capacity auction in PJM will have a significant impact on commercial and industrial customers. Consumers across PJM will pay $14.7 billion for capacity in the 2025-2026 delivery year, up from $2.2 billion in the previous auction. To put this into perspective, the previous ten auctions averaged $6.52 billion and the next highest auction result was $10.9 billion in the 2018-2019 delivery year.

PJM’s capacity market is called the “Reliability Pricing Model.” The auction is designed to secure resources to meet the RTO reliability requirement for the 2025/2026 delivery year. The latest auction prices were significantly higher across PJM due to decreased electricity supply primarily caused by a large number of generator retirements, increased electricity demand and implementation of FERC-approved market reforms.

According to the Natural Resources Defense Council, one reason capacity prices are going up is because natural gas prices are going down. “Lower natural gas prices means that fewer coal plants will continue operating, which creates a little more scarcity in the capacity markets until new generation and energy efficiency are integrated into the system.”