Risk Appetite Broken Record Warning!

February 17, 2020

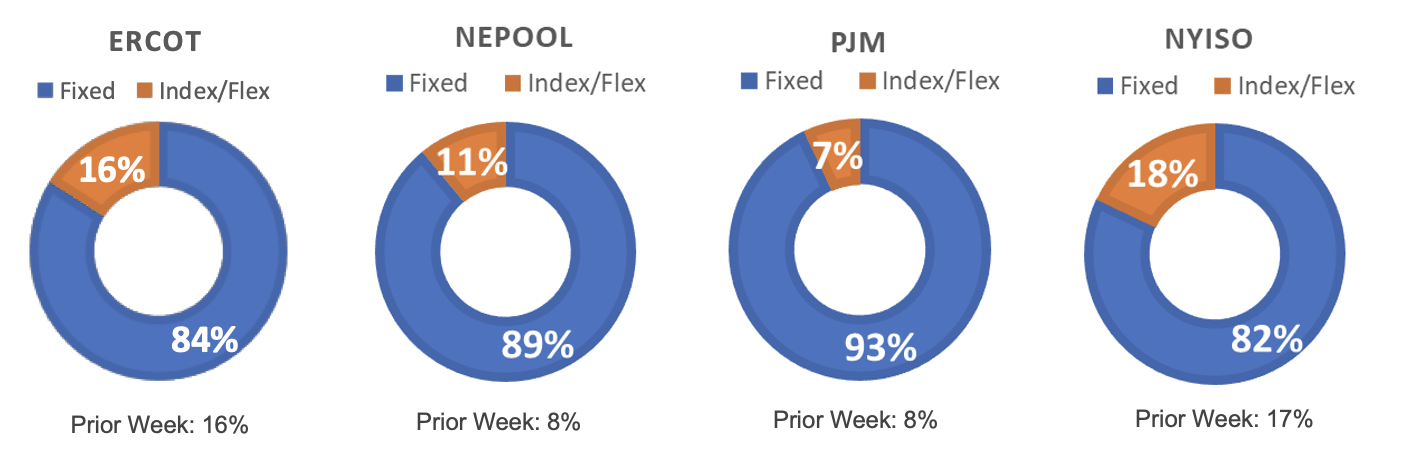

Energy procurement professionals are happy right where they are. The appetite for risk across markets served by ENGIE has been rock steady for several weeks. NYISO and ERCOT continue to show a double-digit ratio of interest in index/flex products while NEPOOL and PJM show a greater preference for fixed price.

Risk Appetite Report 2/11/20 – 2/17/20

The risk appetite gauges above reflect the mix of fixed, flex and index volume that were priced on behalf of customer requests in the period. Total annual MWh priced represents 213,882,476 for customers with peak demand above 750 KWh.