Risk Off in PJM

June 14, 2021

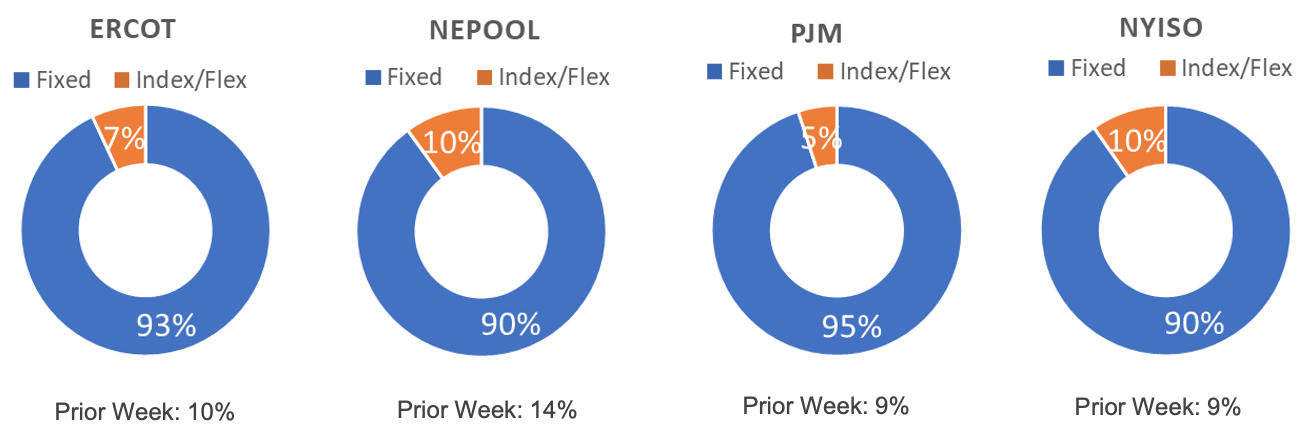

Three weeks ago, buyers and brokers in PJM requested pricing requests that reflected a 24% interest in index/flex products. Two weeks ago, that interest dropped to 9%, and last week, only 5% of their interest was focused on index/flex solutions. All four markets show a consistent interest level in fixed price products at a 90% or more ratio.

Risk Appetite Report 6/7/21 – 6/11/21

The risk appetite gauges above reflect the mix of fixed, flex, and index volume that was priced on behalf of customer requests in the period. The total annual MWh priced represents 148,392,745 for customers with peak demand above 750 KWh.